41+ maximum mortgage interest deduction 2020

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Taxpayers can deduct mortgage interest on up to.

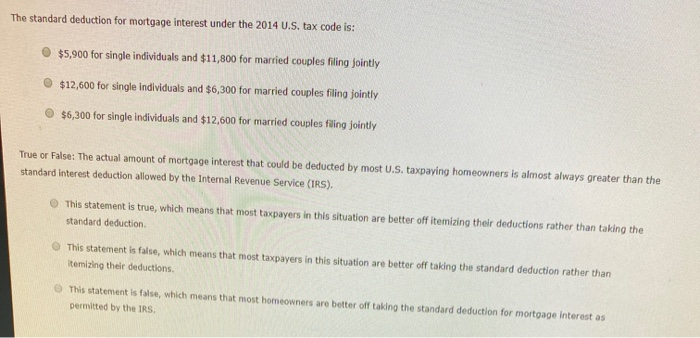

Solved The Standard Deduction For Mortgage Interest Under Chegg Com

To claim the mortgage interest deduction simply fill out IRS Form 1098.

. Beginning in 2018 the maximum amount of debt is limited to. However higher limitations 1 million 500000 if married. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Web The 2020 mortgage interest deduction Mortgage interest is still deductible but with a few caveats. Single taxpayers and married taxpayers who file separate returns. Web Most homeowners can deduct all of their mortgage interest.

Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Web Standard deduction rates are as follows. Ad Access Tax Forms.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Complete Edit or Print Tax Forms Instantly.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. 12950 for tax year 2022.

Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now. Web For tax years prior to 2018 the maximum amount of debt eligible for the deduction was 1 million. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

If you took out your home loan before. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. Web Add 1300.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Homeowners who bought houses before December 16. For tax year 2022 those amounts are rising to.

Then report your home mortgage interest on Line 8 of Schedule A in IRS.

Mortgage Interest Deduction How It Works In 2022 Wsj

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Mortgage Interest Tax Deduction What You Need To Know

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

Home Mortgage Loan Interest Payments Points Deduction

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Interest Deduction Bankrate

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Mortgage Interest Deduction How It Calculate Tax Savings

Drs A

Mortgage Interest Deduction Who Gets It Wsj